Which is an example of a short-term investment quizlet – In the world of investing, short-term investments, which are an example of a short-term investment quizlet, offer a unique blend of liquidity, reduced risk, and potential returns. This guide delves into the intricacies of short-term investments, exploring their types, characteristics, and strategies for maximizing their benefits.

Short-Term Investments: Overview

Short-term investments are financial instruments with a maturity period of less than one year. They provide investors with a means to park their funds for a short duration while generating returns. Examples include treasury bills, money market accounts, and short-term bonds.

Characteristics of short-term investments include high liquidity, low risk, and moderate returns. They are considered safe havens during periods of market volatility and can serve as a source of emergency funds.

One example of a short-term investment is a money market account. These accounts offer a low rate of return but are considered safe and liquid. For those seeking higher returns, investing in the stock market can be a lucrative option.

People who make money investing in the stock market often do so by buying stocks of companies they believe will increase in value over time. Another example of a short-term investment is a certificate of deposit (CD), which offers a fixed interest rate over a specified period.

Examples of Short-Term Investments

| Investment Type | Maturity Period | Average Return | Risk Level |

|---|---|---|---|

| Treasury Bills | Less than 1 year | 1-3% | Low |

| Money Market Accounts | Flexible | 1-2% | Low |

| Short-Term Bonds | Less than 5 years | 2-4% | Low to Moderate |

| Certificates of Deposit (CDs) | Fixed term (usually less than 1 year) | 1-3% | Low |

Benefits of Short-Term Investments

Investing in short-term investments offers several advantages:

- Liquidity:Short-term investments can be easily converted into cash, providing investors with access to funds when needed.

- Risk Reduction:Due to their short maturity periods, short-term investments are less susceptible to market fluctuations and interest rate changes.

- Returns:While returns on short-term investments are generally modest, they can provide a steady stream of income and outpace inflation.

Risks of Short-Term Investments

Investing in short-term investments also carries potential risks:

- Market Volatility:Although short-term investments are less volatile than long-term investments, they can still be affected by market conditions.

- Interest Rate Fluctuations:Changes in interest rates can impact the returns on short-term investments, particularly for fixed-income securities.

- Inflation:Returns on short-term investments may not keep pace with inflation, potentially eroding the purchasing power of the invested funds.

Strategies for Investing in Short-Term Investments, Which is an example of a short-term investment quizlet

To maximize returns while minimizing risks, consider the following strategies:

- Diversification:Spread your investments across different types of short-term investments to reduce risk.

- Timing:Invest in short-term investments when interest rates are expected to rise or when market volatility is low.

- Risk Management:Set investment limits and monitor your portfolio regularly to ensure alignment with your risk tolerance.

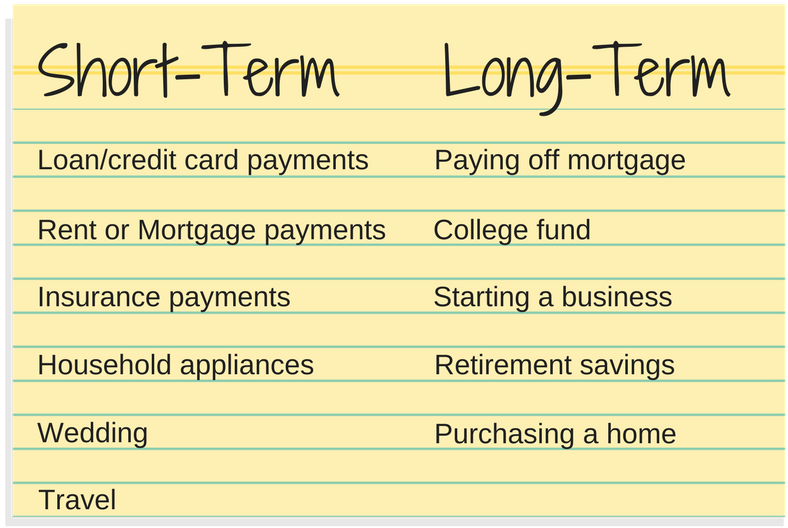

Comparison to Long-Term Investments

| Characteristic | Short-Term Investments | Long-Term Investments |

|---|---|---|

| Investment Horizon | Less than 1 year | More than 1 year |

| Risk Level | Low to Moderate | Moderate to High |

| Potential Returns | Modest | Higher |

| Liquidity | High | Lower |

Last Recap

Whether you’re a seasoned investor or just starting out, understanding short-term investments can empower you to make informed decisions and navigate the financial landscape with confidence. By embracing the principles Artikeld in this guide, you can harness the potential of short-term investments and achieve your financial goals.

Questions and Answers: Which Is An Example Of A Short-term Investment Quizlet

What is the primary advantage of short-term investments?

Short-term investments provide high liquidity, allowing investors to access their funds quickly and easily.

How can short-term investments help reduce risk?

Short-term investments are typically less volatile than long-term investments, reducing the risk of significant losses.