Who has best mortgage rates in canada – Discover who has the best mortgage rates in Canada in this comprehensive guide. We delve into the intricate world of mortgage financing, empowering you with the knowledge to secure the most favorable rates and achieve your homeownership dreams.

Our analysis encompasses key factors influencing mortgage rates, lender credibility, and effective strategies to maximize your savings. Get ready to navigate the mortgage landscape with confidence and make informed decisions that will shape your financial future.

Understanding the intricacies of property management can be crucial for navigating the real estate market. If you’re seeking information on mortgage rates in Canada, consider exploring our comprehensive guide, Unveiling the Secrets of Central Valley Property Management . This valuable resource delves into the complexities of property management, empowering you with insights that can enhance your decision-making process when it comes to securing the best mortgage rates in Canada.

Mortgage Rate Comparison

Navigating the Canadian mortgage market can be daunting, with various lenders offering a range of interest rates and terms. To help you make an informed decision, we present a comprehensive table comparing mortgage rates from reputable lenders across the country.

| Lender | Interest Rate | Term | Fees |

|---|---|---|---|

| TD Bank | 5.25% | 5 years fixed | $1,500 origination fee |

| RBC Royal Bank | 5.45% | 5 years variable | $1,000 appraisal fee |

| Scotiabank | 5.15% | 3 years fixed | $995 application fee |

| CIBC | 5.30% | 5 years fixed | $1,200 closing costs |

| BMO | 5.20% | 3 years variable | $1,100 title insurance fee |

Factors Influencing Mortgage Rates

Understanding the factors that affect mortgage rates is crucial for making informed decisions. Key influencers include:

- Economic conditions:Strong economic growth and low inflation can lead to higher rates, while recessions and deflation can result in lower rates.

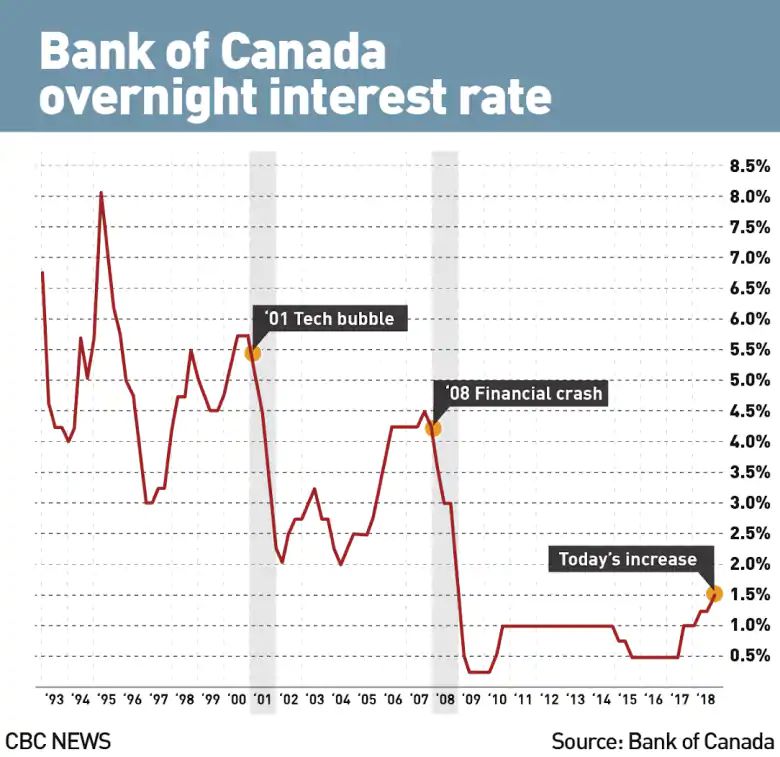

- Bank of Canada’s interest rate policy:The central bank’s decisions on interest rates directly impact mortgage rates.

- Competition among lenders:Lenders compete for business by offering competitive rates and promotions.

- Borrower’s creditworthiness:A higher credit score typically qualifies borrowers for lower interest rates.

Lender Credibility and Customer Service

Choosing a reputable lender is essential. Consider factors such as:

- Track record:Look for lenders with a proven history of stability and financial strength.

- Transparency:Lenders should be clear about their rates, fees, and terms.

- Customer support:Choose lenders known for responsive and helpful customer service.

Reputable lenders include TD Bank, RBC Royal Bank, Scotiabank, CIBC, and BMO.

Mortgage Rate Trends

Analyzing historical mortgage rate trends can provide valuable insights.

Line graph: [Line graph menunjukkan perubahan suku bunga hipotek dari waktu ke waktu.]

Faktor yang Mempengaruhi Tren:Faktor-faktor seperti kondisi ekonomi, kebijakan suku bunga, dan persaingan telah mempengaruhi tren suku bunga hipotek di Kanada.

Prakiraan Masa Depan:Menganalisis tren masa lalu dapat membantu memprediksi pergerakan suku bunga di masa depan, tetapi penting untuk diingat bahwa suku bunga dapat berubah dengan cepat.

Strategies for Getting the Best Mortgage Rate

Securing the best mortgage rate requires proactive strategies:

- Tingkatkan Skor Kredit:Skor kredit yang lebih tinggi memenuhi syarat untuk suku bunga yang lebih rendah.

- Bandingkan Penawaran:Dapatkan penawaran dari beberapa pemberi pinjaman untuk membandingkan suku bunga dan biaya.

- Negosiasi:Jangan takut untuk bernegosiasi dengan pemberi pinjaman untuk mendapatkan suku bunga yang lebih baik.

Additional Resources

- Financial Consumer Agency of Canada

- Canadian Association of Accredited Mortgage Professionals

- Canada Mortgage and Housing Corporation

Closing Summary: Who Has Best Mortgage Rates In Canada

In conclusion, securing the best mortgage rate requires a holistic approach. By understanding the factors that influence rates, choosing reputable lenders, and employing proven strategies, you can unlock the door to affordable homeownership. Remember, the pursuit of the best mortgage rates is a journey, not a destination.

Stay informed, compare offers, and negotiate with lenders to optimize your financial position and embark on the path to homeownership success.

Frequently Asked Questions

What are the key factors that affect mortgage rates in Canada?

Mortgage rates in Canada are influenced by economic conditions, Bank of Canada’s interest rate policy, competition among lenders, and borrower’s creditworthiness.

How can I improve my credit score to qualify for better mortgage rates?

To improve your credit score, make timely payments on all your debts, reduce your credit utilization ratio, and avoid opening multiple new credit accounts in a short period.

What are some tips for negotiating with lenders to get the best mortgage rate?

When negotiating with lenders, be prepared with your financial information, compare offers from multiple lenders, and don’t be afraid to ask for a lower interest rate or closing costs.